Title Insurance

Title Insurance

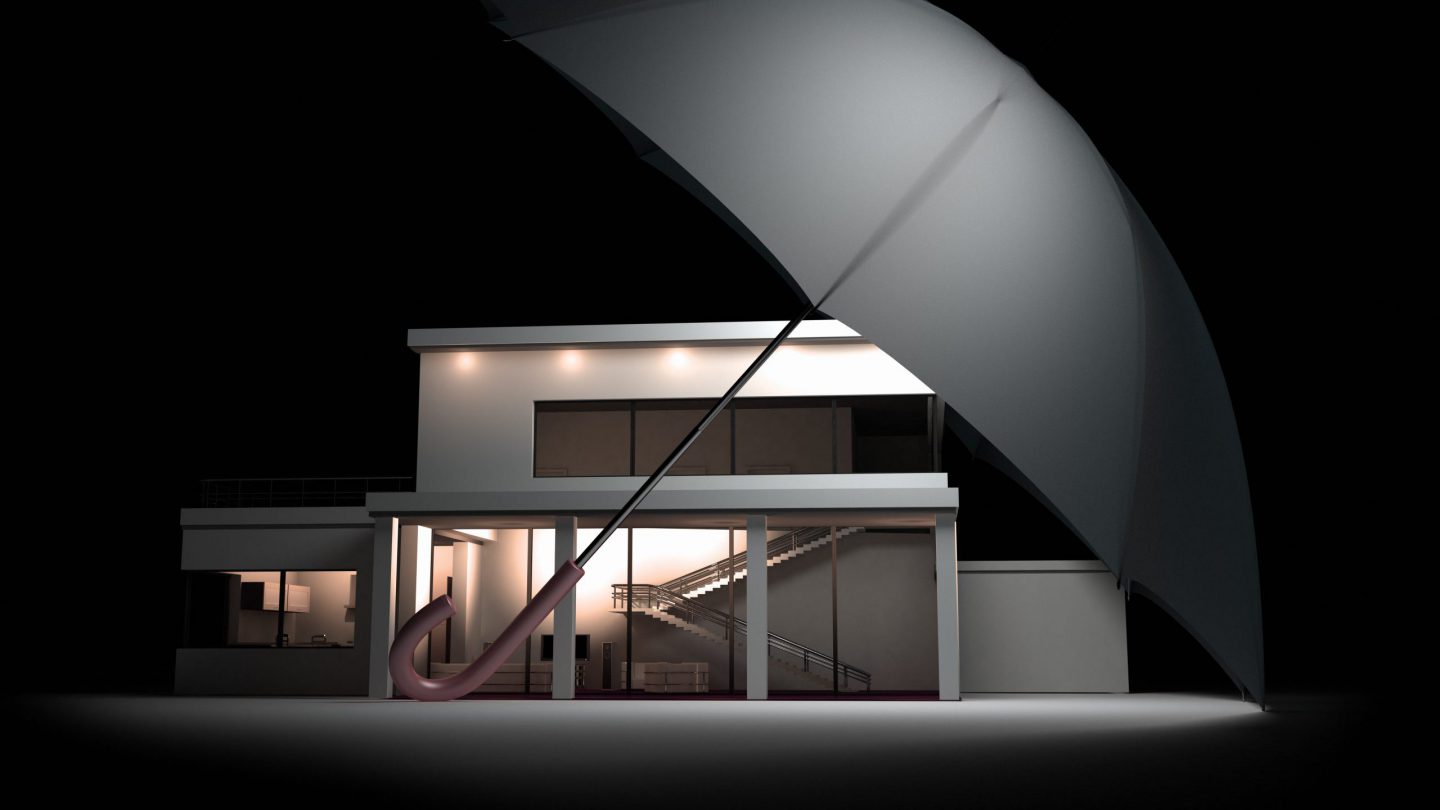

Buying a home is an important investment. Title Insurance is what protects the buyer’s financial interest in their home from loss associated with title defects, liens, or encumbrances. It is the most effective, most accepted, and least expensive way to protect a buyer’s home ownership investment. An important part of title insurance is its emphasis on risk elimination before insuring. This gives you, the policy holder, the best possible chance for avoiding title claims and loss.

When you buy a home, you expect to enjoy certain benefits from ownership and to be able to occupy and use the property as you wish. This gives you, the policy holder, the best possible chance for avoiding title claims and loss. Title insurance is designed to cover these rights.

Throughout the years, your new property may have changed hands many times through a sale, inheritance, foreclosure or bankruptcy. Each transfer presents an opportunity for an error in the chain of title to arise. If an error occurred and was not found, it can put the title to your property in jeopardy. An important part of title insurance is its emphasis on risk elimination before insuring. This gives you, the policy holder, the best possible chance for avoiding title claims and loss.

Even though our team at Vision Title has provided a very thorough title search, an Owners title insurance policy will give additional protection. Here are a few of the more common title claims that could affect your property:

- Unpaid Taxes

- Lack of competency, capacity or legal authority of a party

- Mistakes in recording of legal documents

- Undisclosed or missing heirs

- Erroneous or inadequate legal descriptions

- Misrepresentation of marital status

- Undisclosed federal or state tax lien

- Undisclosed prior Mortgages

- Clerical errors in public records

- Wills not probated

- Invalid Divorces

- Forgery and impersonation

- Unpaid but non recorded Home Owners Association Liens

What does it cost?

Each policy price is based on the purchase amount of the home (for an owner’s policy) or the total amount of the loan (for a lenders policy). Please call our office or go to our Website for a title insurance quote based on your specific transaction.

Length of Coverage

Also, unlike other types of insurance, the purchase of an owner’s title insurance policy is a one-time event: there are not future premiums to pay as long as the homeowner or their heirs hold an interest in the property. That means that this fee, generally paid when the buyer purchases the property, will protect the homeowner and their family indefinitely for so long as they hold an interest in the property